Venture capitalists invested more than $18 billion in food technology startups during the 2020 pandemic year.

Trends in FoodTech Investing

Trends in FoodTech Investing

David Feldman, Early stage investor. Associate | Touchdown VC

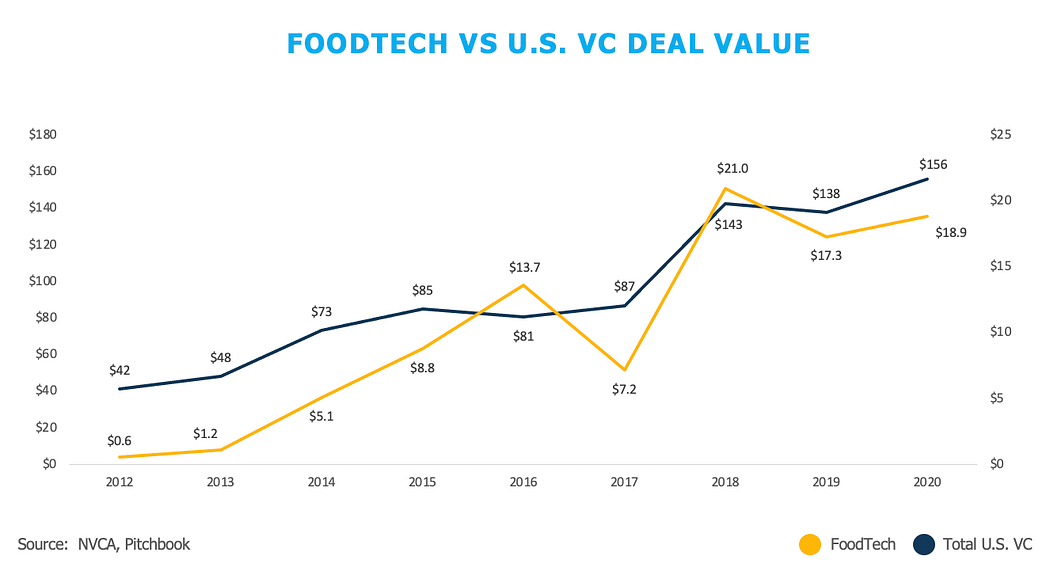

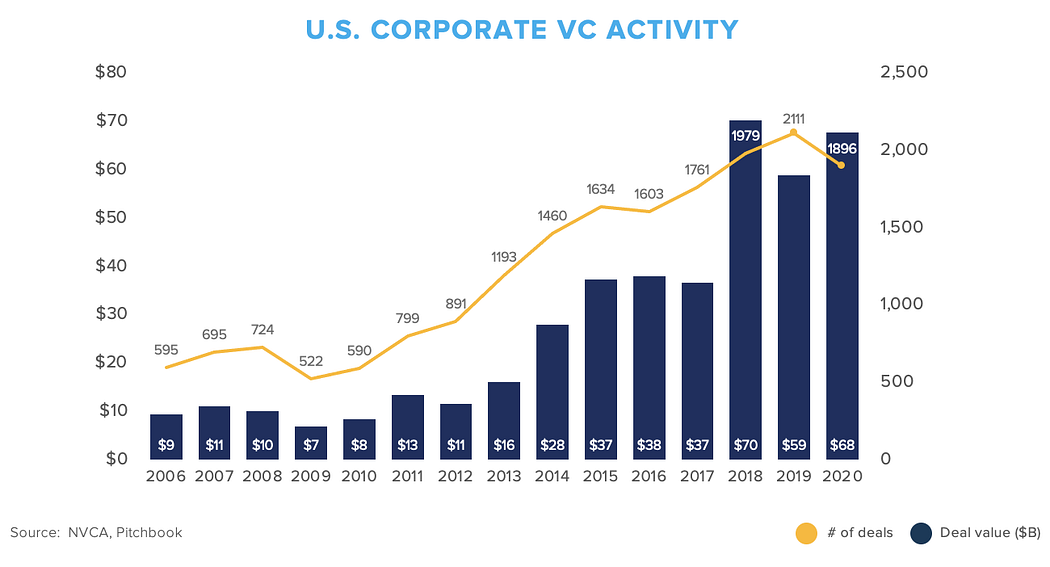

Expectations regarding venture capital diverged from results in 2020, as PitchBook highlighted last July. At the onset of the pandemic in March of 2020, many anticipated that funding activity would slow down amidst the uncertainty of lockdowns, social distancing, and strains on the overall economy. Yet 2020 proved to be a record year for venture in the U.S., with $156B invested in startups and $74B raised by VC funds. Also, contrary to what experts might expect at the start of an apparent downturn, corporate VCs (CVCs) nearly matched their 2018 high, investing $68B.

“FoodTech” startups received a record amount of venture capital in 2020, with $18.9B invested in companies in the category, a nearly 10% increase over the 2019 total. According to PitchBook, FoodTech refers to companies developing technology intended to improve consumer experiences in food selection, purchasing, and consumption. Drivers of this funding and overall trends in the FoodTech market included:

- Supply chain disruptions and stock outages for traditional meat and dairy products, as well as a focus on healthy eating habits, accelerated demand for alternative protein solutions

- The need for easy-to-prepare meals and flexible restaurant takeout options during lockdowns spurred funding into direct-to-consumer meal kit, e-commerce, and food delivery companies

- Investors also backed solutions to improve the cost of food production and distribution while also ensuring safety, and provided funding for startups identifying optimal flavors, textures, and ingredient combinations

Including data from PitchBook and NVCA’s quarterly Venture Monitor report, this analysis shares highlights from the U.S. VC industry as a whole, as well as observations specific to the FoodTech startup market, based on Touchdown’s work with eighteen94 capital, Kellogg’s corporate venture capital fund.

FoodTech & VC Funding Highlights

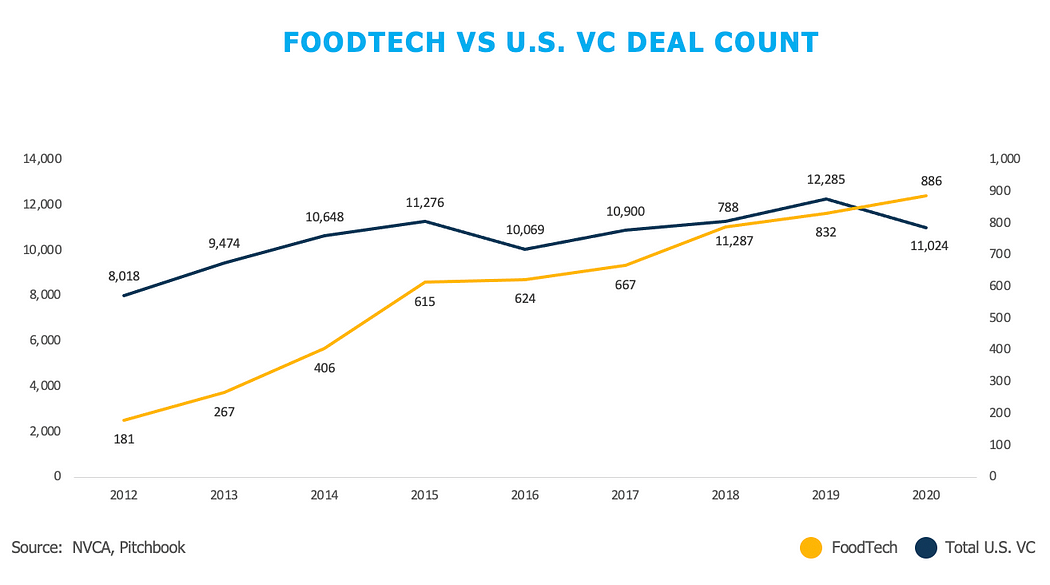

2020 was a record year for VC activity in the U.S., with $156B invested. However, the total deal count decreased from 2019, indicating that VCs concentrated funding in larger deals with fewer companies.

The FoodTech sector mirrored the overall market, with $18.9B invested in 886 companies, a 9% increase from the number of deals in 2019. In particular, deal value to plant-based meat alternatives grew 20% in 2020, reflecting a consumer preference for more sustainable and healthy substitutes. However, FoodTech funding saw a greater percentage increase in funding value over the past 4 years than the U.S. market as a whole, suggesting that sector specific factors created excitement among investors.

Here is the FoodTech deal count compared to the overall U.S. market:

There is no doubt that the coronavirus pandemic fundamentally changed consumption patterns among consumers, but it also had a profound impact on the food manufacturing industry as a whole. COVID-19 infections within the industry led to shutdowns and supply disruptions, leading to shortages and increased prices paid by the public. These factors led to an increased focus on maintaining food supply chains and have accelerated a shift to automation and related technological advancements. As a result, artificial intelligence technologies, food safety and traceability platforms, food delivery, and cloud retail companies (retail companies leveraging the data analytic capabilities delivered by cloud computing) attracted record levels of venture investment.

Food alternatives, particularly alternative proteins as noted, benefited from the meat packing industry’s woes and shifting consumer sentiment. When the coronavirus first emerged in the U.S., sales of vegan meat substitutes rose to triple-digit growth rates. These alternative protein solutions — such as plant-based meat and dairy products — give consumers a sense of comfort in knowing where their food comes from and that it is environmentally friendly.

The pandemic also shed light on human “gut microbiome” and its impact on overall health and wellness. Consumers are seeking more foods with active health benefits like boosting immunity. While research on how the gut microbiome affects overall health is relatively new, over $1 billion has been invested in U.S. gut microbiome startups over the past five years, with over $3.4 billion invested globally over the same period, per PitchBook.

CVC Highlights

In 2020, corporate funds deployed 48% by dollar value and participated in 26% of the deals in the United States. As shown in the chart below, the $68B invested by corporations was nearly $10 billion more than 2019, which suggests CVCs remained in the market despite economic uncertainty, as Touchdown co-founder Scott Lenet forecasted in this post from 2019.

CVCs are an important source of capital for FoodTech startups, particularly those that would benefit from strategic or commercial partnerships with large corporations. For R&D intensive startups, the expertise and scientific resources of big corporations can meaningfully accelerate commercialization. The following CVCs are some of the most active FoodTech investors:

- Kraft Heinz’s Evolv Ventures invests in emerging technologies across the food value chain. As an example, Evolv invested in Zippin, a provider of autonomous shopping checkout technology, in October of 2019.

- Tyson Ventures invests in FoodTech companies that are focused on food safety such as Clear Labs, a genomic-based testing platform offering food safety and quality programs.

- Danone Manifesto Ventures focuses on food and food technology businesses that are disrupting eating and drinking habits. The firm invested in Sun Genomics, a company that provides personalized probiotic solutions based on whole-genome sequencing diagnostics.

- From its original investment in Kuli Kuli, a moringa-based products brand, to its most recent investment in Plantible, a plant protein manufacturer, Kellogg’s eighteen94 capital invests in both CPG brands and their enabling platforms.

Notable FoodTech Deals & Exits

- U.S. plant-based protein leader Impossible Foods closed a $500 million Series F in March 2021. It’s conceivable that the next opportunity in the category will be plant-based chicken, as Impossible recently announced the launch of plant-based chicken nuggets, which followed rival Beyond Meat’s rollout of its new vegan chicken tenders.

- Animal-free dairy pioneer Perfect Day increased its Series C round to $300 million in July 2020, with plans to launch a new ice cream brand. The company develops proteins that are nutritionally identical to those from cow’s milk. Other companies that focus on replacing dairy milk include NotCo, a company that uses A.I. to match animal proteins to their ideal replacements among thousands of plant-based ingredients. NotCo raised a $235 million Series D in July 2021 to expand its product lines in milk, cream, mayonnaise, and meat replacements.

- Ordermark closed a $120 million Series C in October 2020. The company’s technology can route online orders from multiple ordering services to a single printer for fulfillment. The company will use this funding to partner with more restaurants and scale its “ghost kitchen” platform, NextBite.

- In March 2021, developer of plant-based egg alternatives and lab-grown meat Eat Just raised $200M. The money will be used to increase its cell-based meat subsidiary’s production capacity and accelerate research for cultivating meat from cells harvested from animals.

- Eighteen94 portfolio company Myco Technology uses fungi-based food-processing platforms to transform the flavor and value of agricultural products. The company has raised over $100 million in funding, with its most recent round being a $39 million Series D in June 2020. Other startups working on use-cases for mushrooms in food have raised similar amounts of funding. Companies operating in this space include Meati Foods, Mycorena, Prime Roots, and Enough.

Food Innovation In the News

- Microbiome care could increase lifespan — Advancements in microbiome care might allow humans to live longer.

- Technology is making plant-based food look and taste better — Startups are now focused on creating a better plant-based food experience for the consumer.

- Sugar reduction is top of mind for consumers and manufacturers — Stevia and functional fiber may offer potential to cut sugar consumption and improve gut health.

About David Feldman

David Feldman is an Associate at Touchdown Ventures, a Registered Investment Adviser that provides “Venture Capital as a Service” to help corporations launch and manage their investment programs.

This article includes information from third party sources believed to be reliable; however, we make no representations as to its accuracy or completeness. References to strategies are for illustrative purposes only and should not be relied upon as a recommendation to engage in any particular strategy or to invest in any particular security. Opinions expressed herein are based on current market conditions and may change without notice and we reserve the right to change any part of these materials without notice and assume no obligation to provide an update. Recipients are advised not to infer or assume that any securities, strategies, companies, sectors or markets described will be profitable or that losses will not occur. Any description or information regarding investment process or strategies is provided for illustrative purposes only, may not be fully indicative of any present or future investments and may be changed at the discretion of the manager. Past performance is no guarantee of future results.

The content & opinions in this article are the author’s and do not necessarily represent the views of AgriTechTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product