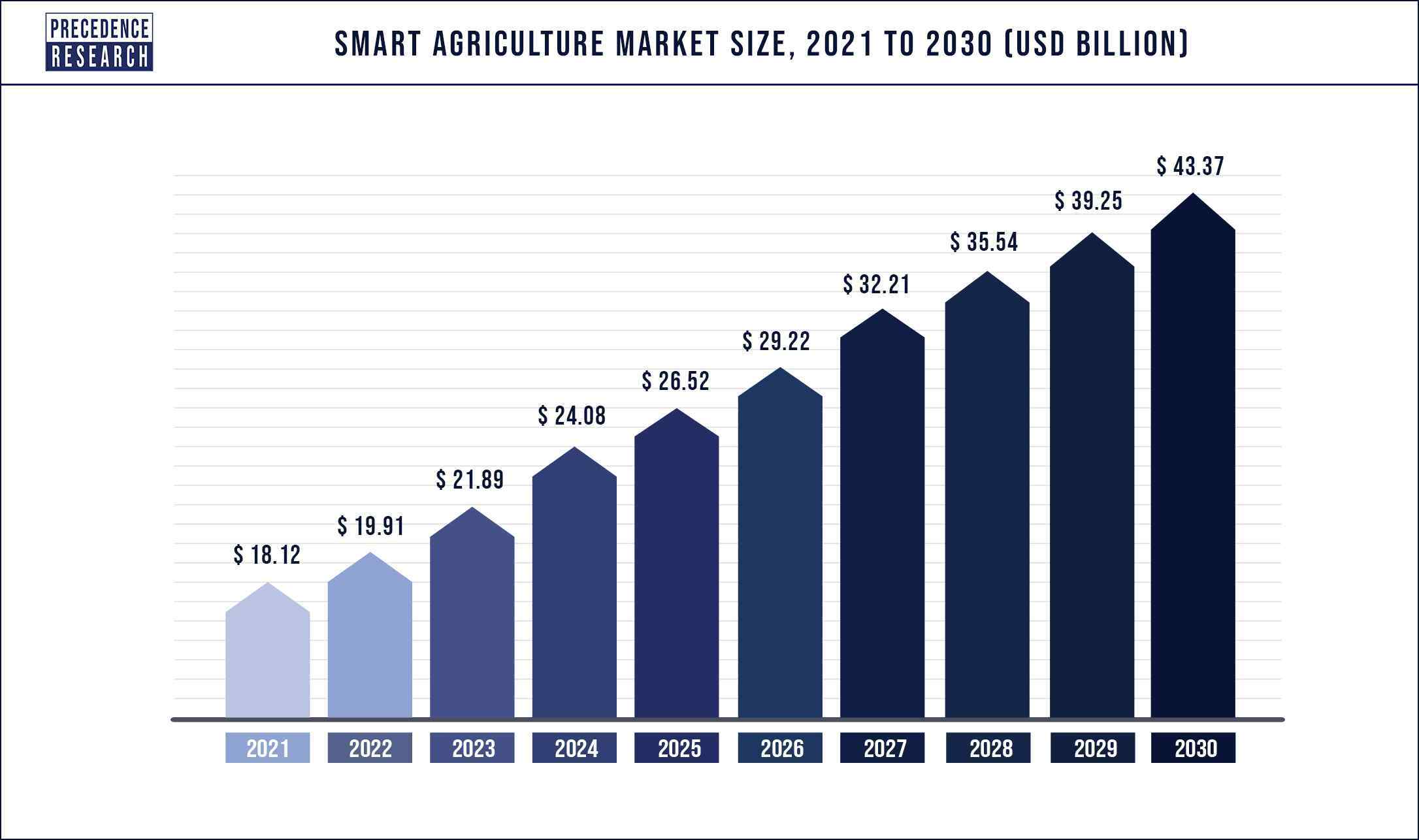

The global smart agriculture market size was estimated at USD 19.91 billion in 2022 and it is expected to hit USD 43.37 billion by 2030 with a registered CAGR of 10.2% from 2022 to 2030.

To Access our Exclusive Data Intelligence Tool with 15000+ Database, Visit: Precedence Statistics

Growth Factors

Smart agriculture is helping farmers to grow crops with more efficiency by utilizing advanced technologies. One of the key factors driving the growth of global smart agriculture market is growing technological advancements and adopting innovative technologies. The technologies such as internet of things, artificial intelligence, blockchain, and machine learning are creating lucrative opportunities for the growth and development of global smart agriculture market over the forecast period.

Another factor driving the growth of global smart agriculture market is growing government initiatives for the adoption of latest and advanced technologies. In addition, government of various developing and developed regions is providing tax benefits to those market players who are operating in smart agriculture market. Moreover, government is also heavily investing for the growth of global smart agriculture market.

The impact of the COVID-19 pandemic on the growth of global smart agriculture market was quite moderate in nature. The market players operating in smart agriculture market saw growth as well as decline in the sales of food grains and dairy products. The supply chain disruption and trade restrictions had negative impact on the growth of global smart agriculture market. On the other hand, the stringent government regulations regarding food safety and security had positive outlook on the expansion of global smart agriculture market during 2020.

The other factors such as increasing adoption of smartphones and growth of telecom sector are driving the growth and development of global smart agriculture market. The growing usage of smartphones is helping farmers to track and monitor agriculture activities on farm. It also provides accurate information and data and also helps to keep record on various parameters. Thus, this factor is propelling the demand for smart agriculture in the global market over the forecast period.

Report Scope of the Smart Agriculture Market

| Report Coverage | Details |

| Market Size by 2030 | USD 43.37 Billion |

| Growth Rate from 2022 to 2030 |

CAGR of 10.2% |

| Yield Monitoring Segment Market Share in 2022 | 44.4% |

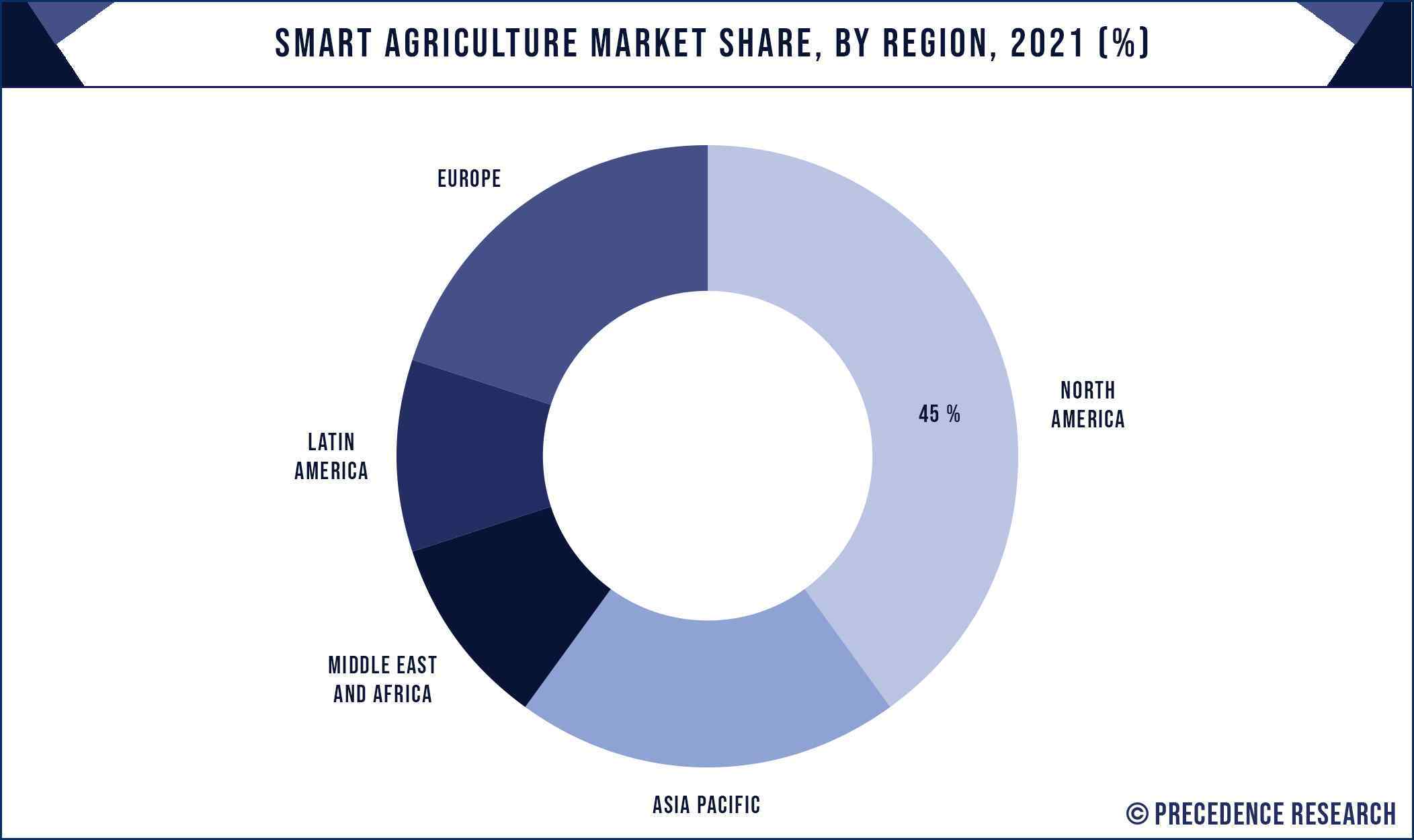

| North America Makret Share in 2022 | 45% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2030 |

| Segments Covered | Agriculture Type, Offering, Application, Farm Size, Geography |

| Companies Mentioned | AG Leader Technology, AGCO Corporation, AgJunction Inc., Autonomous Solutions Inc., Deers& Company, DroneDeploy, Farmers Edge Inc., GEA Group Aktiengesellschaft, The Climate Corporation, DeLaval Inc. |

Agriculture Type Insights

The livestock monitoring segment dominated the market with largest revenue share of over 23% in 2022. The livestock monitoring helps farmers to track and monitor the health of livestock animals. In addition, it also helps for keeping record of productions data of animals. The growth of livestock monitoring segment is also being driven by technological developments and growing demand for dairy products. Moreover, key market players are also launching new products in the market, which is driving the segment growth.

The smart greenhouse segment is fastest growing segment of the smart agriculture market in 2022. The growing environmental concerns and rising greenhouse gases emissions are driving the demand for smart greenhouse in the market. Smart greenhouse helps to maintain climatic conditions, enhance fertilization and irrigation practices, and control infection and avoid disease outbreak. All of these benefits are driving segment growth.

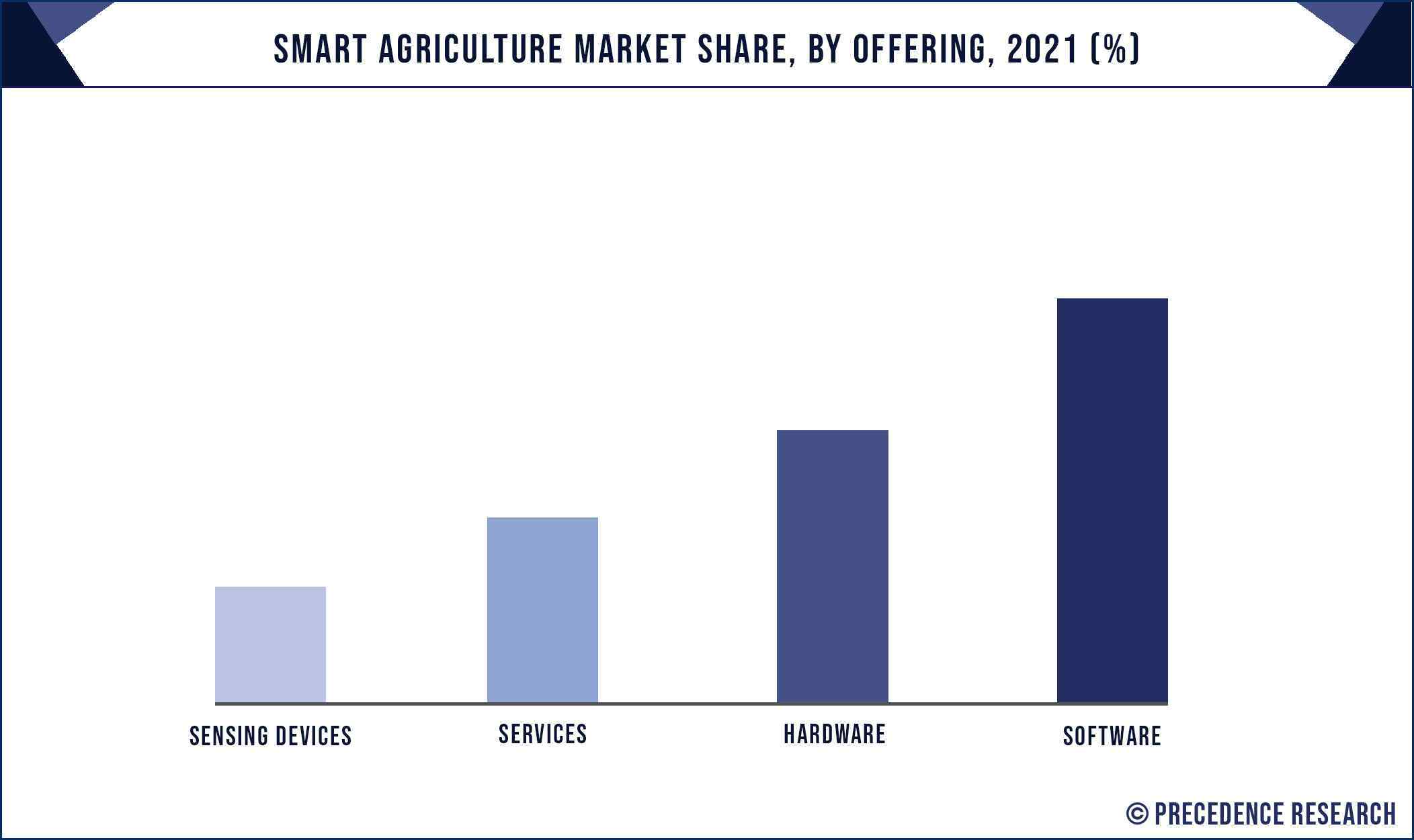

Offering Insights

The software segment dominated the smart agriculture market in 2022 and was valued at USD 3,013.2 million in 2022, growing with a CAGR of 13.5% from 2023 to 2030. The growing technological advancements and adoption of innovative technologies are driving the growth of the segment. The software that is installed in smart agriculture devices and equipment are cloud based and web based. These software help in data collection, data tracking, and data monitoring for farmers and livestock. Thus, software segment is growing at a rapid pace in smart agriculture market.

The hardware segment is fastest growing segment of the smart agriculture market in 2022. The hardware segment is being driven by the rising automation of raw material manufacturing as well as manufacturing of dairy products. This also helps in the reduction of labor costs, which is positively impacting the growth of global smart agriculture market. The trend of growing automation technologies is also helping segment to grow at a strong growth rate.

Application Insights

The precision farming application segment dominated the smart agriculture market in 2022 The precision farming helps to monitoring yield of the crops. In addition, it also tracks and map fields with accurate and precise methods. One of the important applications in this segment is weather tracking and forecasting. The water scarcity and growing environmental concerns are resulting for the expansion of segment. The agriculture purpose depends heavily on water. This factor is boosting the growth of the segment. The yield monitoring segment accounted revenue share of around 44.3% in 2022.

The smart greenhouse application segment is fastest growing segment of the smart agriculture market in 2022. Smart greenhouse helps in managing water and fertilizers on fields effectively and efficiently. Smart greenhouse also supports for determining heating, ventilation, and air conditioning for agriculture purpose. Proper climatic and weather conditions are required for carrying out specific agriculture purposes. All of these factors are propelling the growth of smart greenhouse application segment over the forecast period.

Region Insights

North America dominated the smart agriculture market in 2022 with revenue share of 45%. It is projected to hit at a CAGR of 9.6% over the forecast period. The growth of smart agriculture market in North America region is attributed to the growing government initiatives and favorable guidelines for the expansion of agriculture sector. In addition, several market players are collaborating with government agencies for implementing concept of smart agriculture. Moreover, the government in this region is also providing subsidies and tax incentives for the development of smart agriculture market. All of these factors are driving the growth of smart agriculture market in North America.

Asia-Pacific region is expected to develop at the fastest rate during the forecast period. The growth of smart agriculture market in Asia-Pacific region is being driven by growing government initiatives for agriculture industry. The nations such as Singapore, Japan, and India are taking constant efforts for the growth of smart agriculture market in this region. In addition, government of these countries is providing financial help for developing smart agriculture. Thus, the rise in adoption of organic agriculture is also supporting the growth of smart agriculture market in Asia-Pacific.

Key Developments

Some of the prominent players in the global smart agriculture market include:

Segments Covered in the Report

(Note*: We offer report based on sub segments as well. Kindly, let us know if you are interested)

By Agriculture Type

By Offering

By Farm Size

By Geography

PROCEED TO BUY :

ASK FOR SAMPLE

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client